Digital Asset Inventory: A Complex Business Challenge

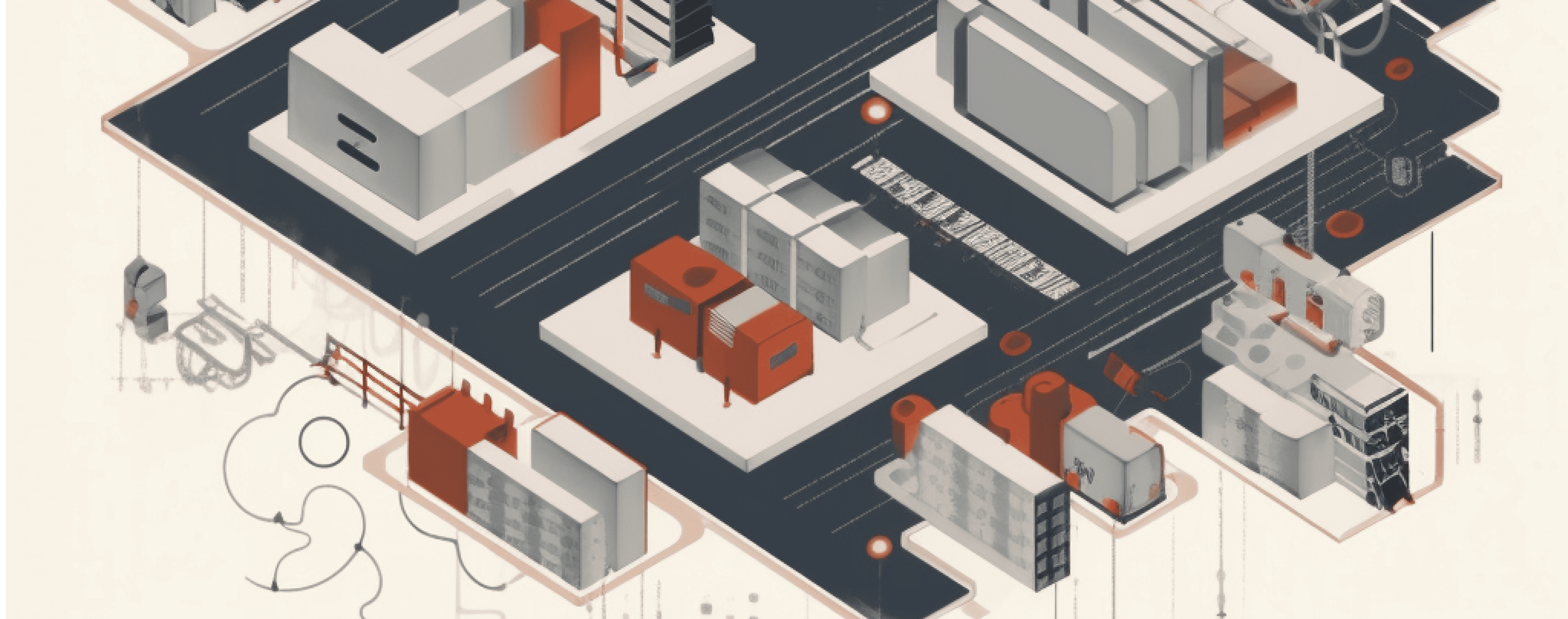

In today’s interconnected world, digital assets—encompassing all digital tools, products, content, data, software, applications, and APIs—underpin every layer of business operations. Whether it’s a small enterprise deploying Shopify, HubSpot, and QuickBooks or a large corporation handling business aspects through advanced digital technologies, digital assets bolster productivity, drive revenue, and enhance customer experience. Nonetheless, the overwhelming proliferation of these assets leaves many firms grappling with an unknown inventory and consequently, uncharted risk terrains.

Quantifying the Value, Assessing the Risk

The labyrinth of managing digital assets transcends merely identifying a firm’s digital repertoire. Each asset potentially houses risks varying from security vulnerabilities to surplus, redundant, or obsolete personal information. When inadequately managed, such risks can rupture business continuity, impacting revenue, brand reputation, and costs.

AI as a Catalyst for Digital Asset Management

Addressing the sheer volume and intricacies of digital assets necessitates AI’s power. Pioneering solutions like SecondSight’s Risk Tracker empowers businesses to constantly monitor their digital asset landscape, spot assets critically linked to their business operations, and track their dynamic risk profile—essentially constructing a behavioral-based risk management strategy.

AI-Powered Risk Reduction: A Case in Point

When a customer recently deployed SecondSight’s comprehensive suite of products across 34 locations, the results were striking—they could reduce their risk surface area by over half. By identifying redundant data across their digital assets, they significantly eliminated risk points, underscoring AI’s immense potential in digital risk management.

A Divergent View: The Right Data for Underwriters is Still Elusive

In the evolving landscape of digital risk management, the dilemma isn’t just about the dearth of adequate data—it’s about the absence of the right data. The conventional belief is that underwriters are equipped with all necessary information, but at Second Sight, we contend with this notion. Traditional data points and risk factors fall short in capturing the intricate nuances of digital risk in our increasingly connected world. The missing element is a comprehensive understanding of severity—the potential fallout of a digital risk event on business continuity.

SecondSight’s vertical operating system bridges this gap. By creating data that provides a lucid picture of digital assets, the risks they carry, and their potential severity, we enable underwriters to comprehend the missing piece. With this critical variable in place, they can devise more accurate, fair, and holistic digital risk insurance policies.

The Role of AI in Streamlining Underwriting

With a holistic understanding of severity across an insurance portfolio, carriers can react across the value chain within an instant. This immediacy in underwriting means carriers can minimize exposure to specific types of risks and communicate changes in near real-time.

Looking Forward: The Dawn of Digital Business Insurance

As businesses march towards an increasingly digital future, AI’s role in digital risk management will assume greater importance. With this novel approach to risk evaluation and management, we’re not just anticipating a new epoch of digital business insurance, but a future where the insurance sector is more efficient, resilient, and adaptive to the fluctuating digital risk landscape.