At SecondSight, our mission is to bridge the gap between small and medium-sized businesses and insurance capacity, ensuring comprehensive protection in the expanding digital landscape. We are dedicated to helping businesses thrive by providing innovative digital risk management solutions that empower them to understand and hedge against the risks associated with digital growth.

Our commitment is to keep you in business by closing the distance between business owners and capacity, fostering a secure and prosperous future for all in the ever-evolving digital world.

Overview

SecondSight is powering the future of cyber insurance with its state-of-the-art digital risk management Artificial Intelligence. By delivering a comprehensive understanding of digital risk severity, we enable companies to make informed decisions regarding their digital risk management strategies.

Inspired by catastrophe modeling and stress-testing practices of commercial property underwriting, our AI adapts these methods to the digital realm. We provide continuous evaluation and assessment of digital assets, creating a solid foundation for next-generation underwriting.

Developing integration protocols and telematics for clients’ digital assets, we empower carriers with insights needed to understand, model, and plan for potential risks. This information equips carriers to optimize their portfolios, effectively manage digital risks, and adapt to the ever-changing cyber landscape.

SecondSight’s approach to cyber underwriting bridges the gap between the digital world and insurance, setting new standards in the quantification and management of digital exposure.

Vision for Tomorrow

SecondSight is at the forefront of providing AI infrastructure to shape the future of underwriting in the face of ever-evolving digital risks.

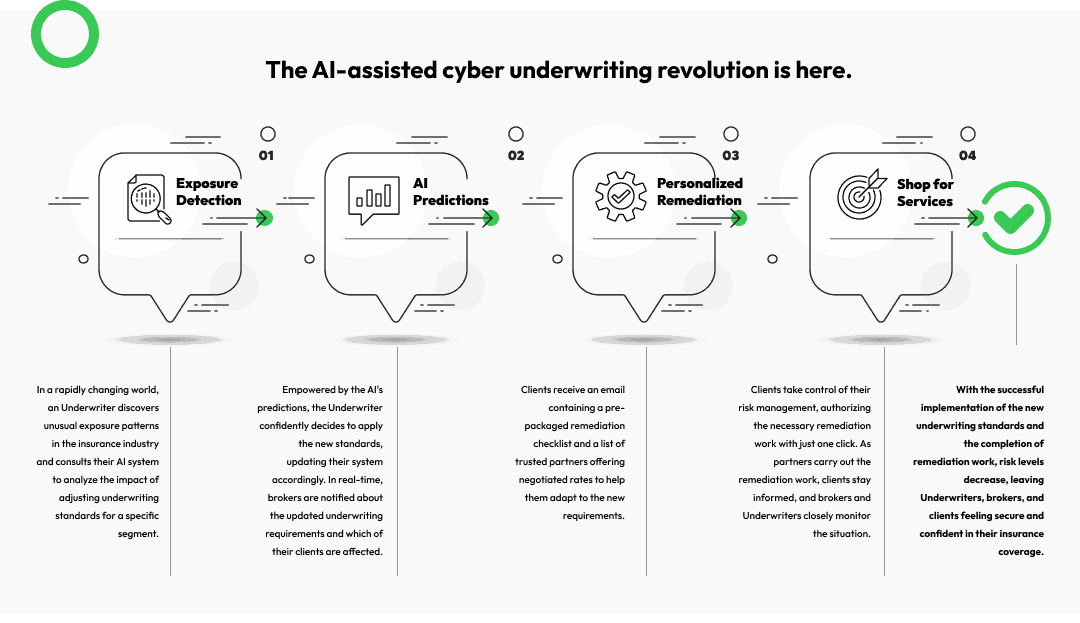

Our vision: An Underwriter notices changes in exposure patterns and re-prompts the AI system to understand the impact of adjusting their underwriting standards for a specific segment. The AI predicts the severity based on these changes, allowing the Underwriter to confidently apply the new standards. In real-time, brokers are notified about the updated requirements and which of their clients are affected. Clients then receive a pre-packaged remediation checklist along with a list of trusted partners offering negotiated rates. With just one click, clients can authorize the necessary remediation work.

We’re not just dreaming of this future; we’re actively building it today. By leveraging the power of neural networks, we’re adapting to the ever-changing landscape of digital risk. As digital expansion leads to infinite possibilities, both in opportunities and risks, our AI infrastructure is designed to handle the known challenges of today and the unforeseen issues of tomorrow – all without the need for constant update cycles.

This capability is essential in a world where no one on the cyber value chain can predict the next type of exposure. Stakeholders need an AI infrastructure that can be re-prompted on a whim, offering agility and responsiveness in the face of uncertainty.

SecondSight is empowering businesses to navigate and thrive in the digital age.