As we enter 2024, the digital landscape continues to pose significant challenges for companies worldwide. The increasing complexity and frequency of cyber threats have put digital risk management at the forefront of boardroom discussions. This shift underscores the need for robust strategies to combat these evolving threats, safeguarding a company’s operational integrity and financial stability. This article delves into the trends and considerations that should be on every board’s radar in today’s fast-paced digital era.

I. The Evolution of Digital Risk Landscape The digital risk environment is becoming more intricate, driven by advancements in technology and the sophistication of cyber attackers. Boards must understand this evolving landscape, which now includes emerging threats like deepfakes, AI-driven attacks, and increasingly complex ransomware strategies. Recognizing these threats is the first step in developing effective risk management strategies.

II. Importance of Proactive Cybersecurity Measures Gone are the days of reactive cybersecurity. In 2024, boards must adopt a proactive approach to digital risk management. This involves continuous monitoring of their cyber environment and preemptive action against potential threats. Tools and platforms that offer real-time insights and predictive analytics are becoming indispensable for informed decision-making and risk mitigation.

III. Integrating Cybersecurity with Business Strategy Cybersecurity is no longer a siloed IT issue; it’s an integral part of overall business strategy. Boards should ensure that digital risk management is embedded in every aspect of their business operations. This integration helps in aligning cybersecurity efforts with business objectives, ensuring a more resilient and agile response to digital threats.

IV. Regulatory Compliance and Cyber Insurance As regulatory landscapes evolve, compliance becomes a more complex yet critical aspect of cybersecurity. Boards must stay abreast of global and regional regulations to avoid legal pitfalls. Additionally, cyber insurance is emerging as a key component of risk management strategies, offering financial protection against cyber incidents.

V. The Role of Leadership in Cybersecurity Culture Leadership plays a pivotal role in shaping a company’s cybersecurity culture. Boards must champion cybersecurity initiatives, promoting awareness and education throughout the organization. A culture that prioritizes cybersecurity can significantly reduce the risk of breaches and improve overall resilience.

VI. Embracing Technological Innovation through SecondSight’s Features

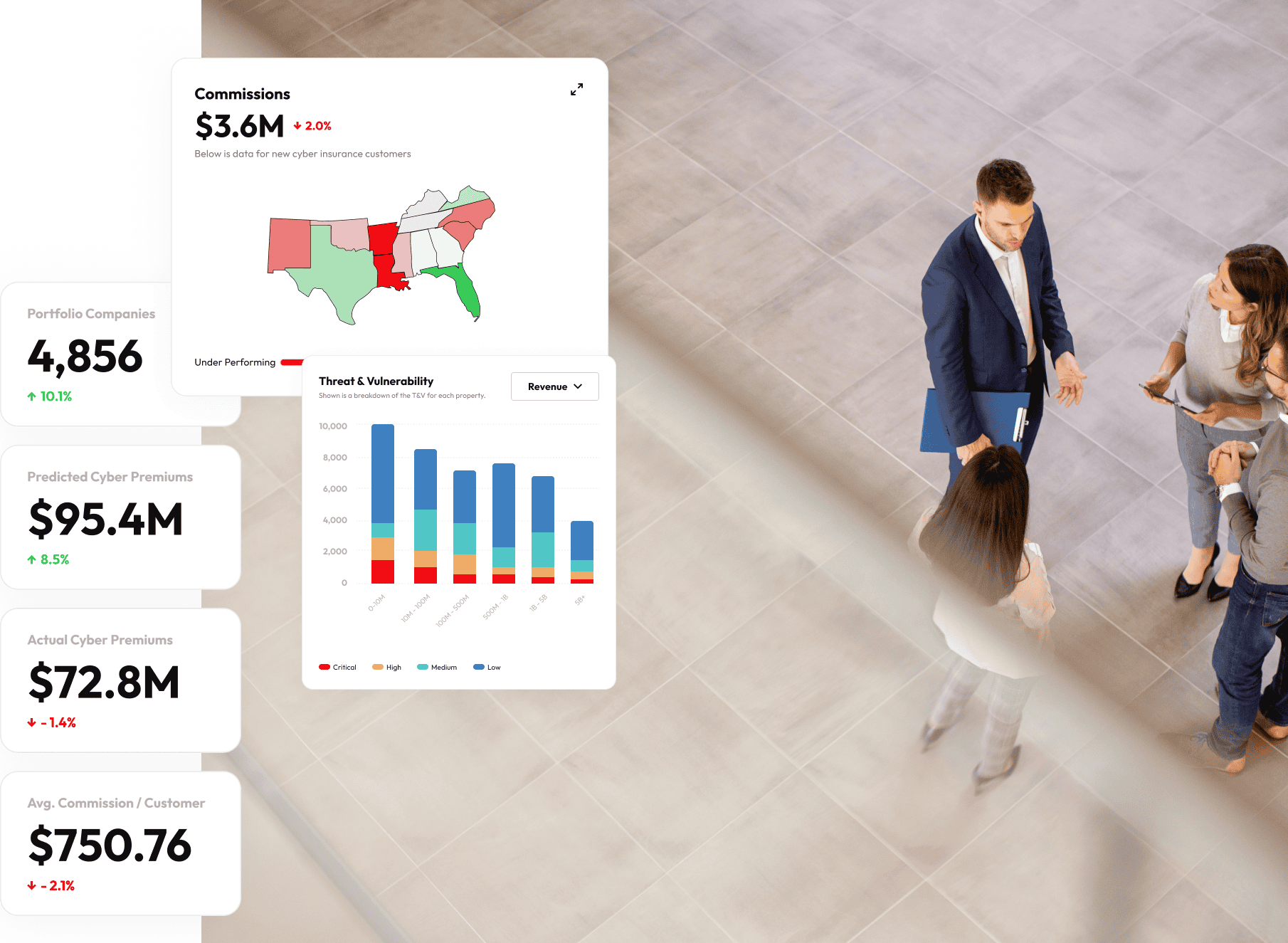

In 2024, as boards navigate the complexities of digital risk, embracing technological innovations like those offered by SecondSight’s Digital Risk Management Platform is essential. SecondSight provides cutting-edge tools and features that not only enhance cybersecurity efforts but also integrate seamlessly with a company’s strategic objectives. Here are key features of SecondSight that boards should leverage:

- Advanced Risk Profiling and Analysis: SecondSight offers sophisticated risk assessment tools that enable boards to gain a comprehensive understanding of their cybersecurity posture. This feature aids in identifying vulnerabilities and prioritizing areas that require immediate attention, aligning risk management with the organization’s strategic goals.

- Cyber Insurance Market Access: Recognizing the growing importance of cyber insurance, SecondSight acts as a facilitator, connecting businesses with suitable cyber insurance options. This aids boards in navigating the insurance landscape, ensuring they obtain coverage that aligns with their specific risk profiles and business needs.

- Continuous Risk Monitoring Tool: Emphasizing a proactive approach, SecondSight’s continuous monitoring tool keeps boards updated on the evolving risk landscape. This real-time data is crucial for making informed decisions and quickly adapting to new threats, ensuring that the company’s cybersecurity measures are always ahead of potential risks.

- Remediation Ecosystem: SecondSight extends its capabilities beyond just risk assessment and insurance facilitation. Its remediation ecosystem connects companies with Managed Service Providers (MSPs) and legal partners for implementing risk mitigation strategies. This feature is instrumental for boards in developing comprehensive, action-oriented approaches to managing digital risks.

- Collaborative Platform for Enhanced Broker-Client Engagement: SecondSight fosters a collaborative environment between brokers and clients, enhancing the insurance lifecycle management. This collaboration ensures that boards are not only involved in policy selection but also in the ongoing management of digital risks, making the governance process more cohesive and responsive.

Incorporating SecondSight’s features into a company’s digital risk management strategy equips boards with the necessary tools to effectively oversee and mitigate cyber risks. The platform’s advanced capabilities in risk analysis, insurance facilitation, continuous monitoring, and remediation, combined with enhanced collaboration, position SecondSight as an invaluable asset for boards striving to fortify their cybersecurity posture in 2024 and beyond.