BROKER SOLUTIONS

MARKET ANALYSIS AND

STRATEGIC PLANNING

Empowering Decision-Making with Advanced Market Analysis and Strategic Planning

GROWTH STRATEGIES

Optimize

DIRECT PLACEMENT EFFICIENCY

Expand

REVENUE GROWTH OPPORTUNITIES

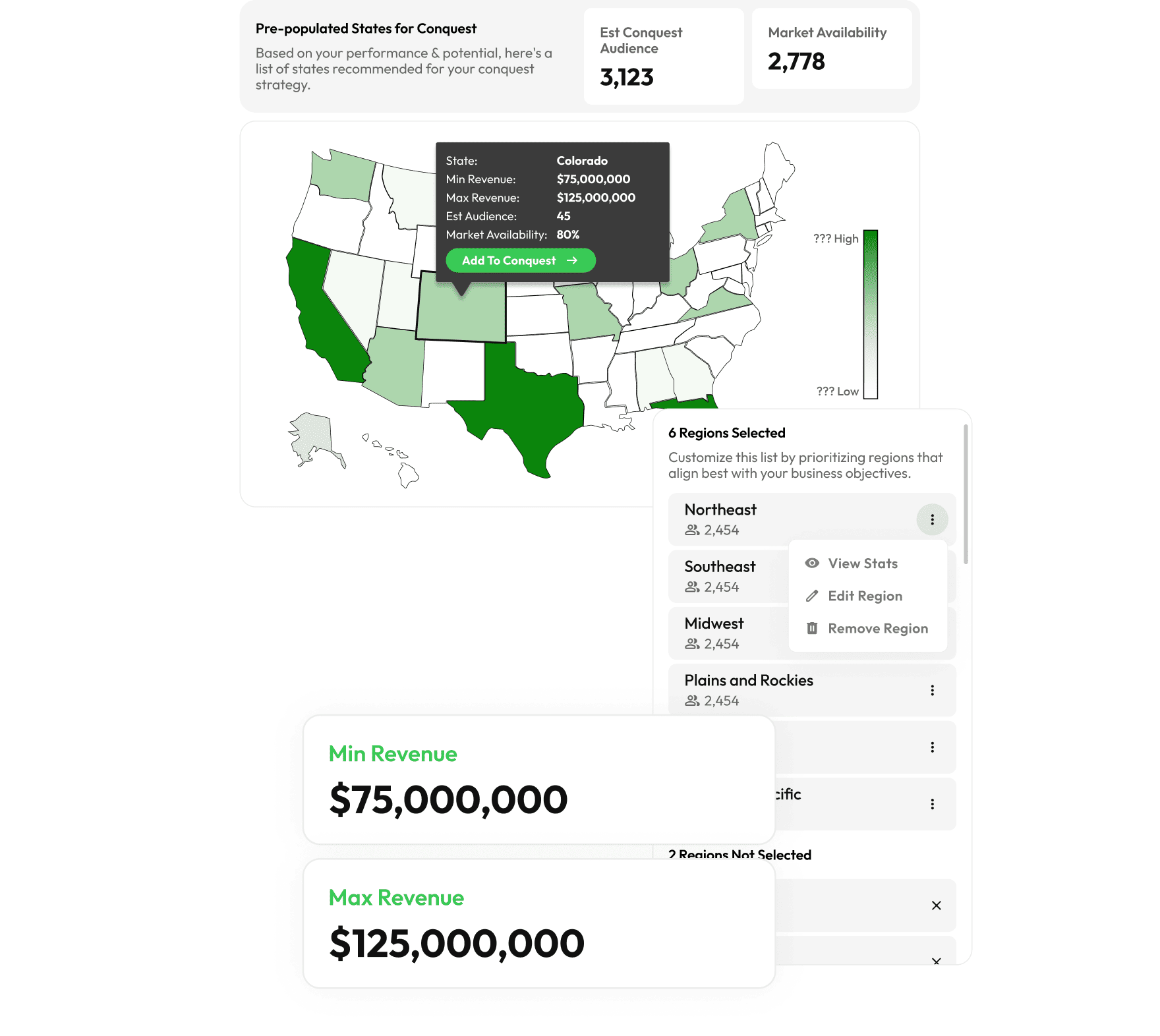

Harness the power of targeted cross-sell and conquest strategies to expand your market share and client base, thereby increasing your overall revenue potential and ensuring sustained business growth.

Scale

RENEWAL

AUTOMATION

AUTOMATION

SIMULATE YOUR GROWTH

UNVEILING YOUR BROKERAGE’S POTENTIAL: DISCOVER BOOK

VALUE WITH SECONDSIGHT

FEATURES & BENEFITS

Comprehensive Cyber Insurance Analytics and Strategic Planning Suite