UNDERWRITER

WORKBENCH

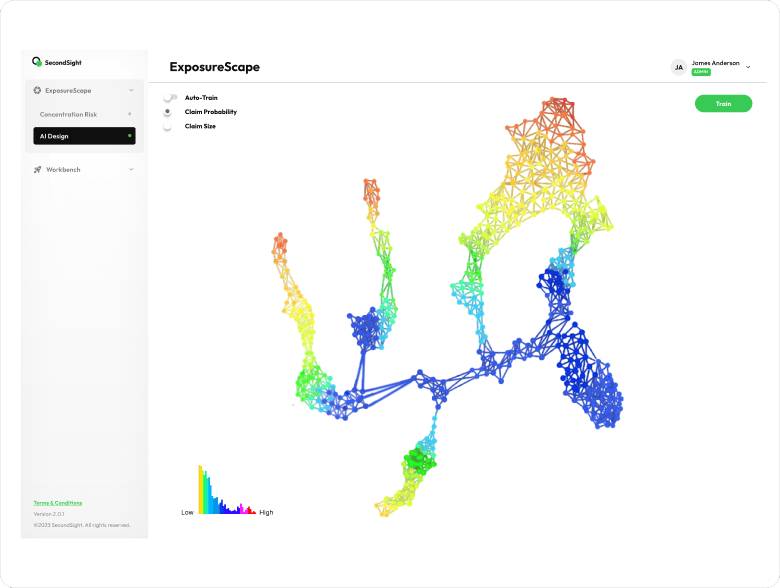

The Underwriter Workbench, integrated with Exposurescape, streamlines the underwriting process by utilizing AI-driven tools for precise risk assessment. This combination empowers underwriters to accurately predict and identify potential cyber risks, enabling informed decision-making and fostering a healthier portfolio through advanced analytics and real-time data integration.

Absolutely. The Underwriter Workbench is built for seamless integration with existing risk analysis systems. Its flexible and interoperable framework means that underwriters can utilize Exposurescape’s cutting-edge predictive capabilities in tandem with current tools, enhancing risk management processes without necessitating significant system modifications.

The Underwriter Workbench, via Exposurescape, provides comprehensive predictive analytics that sift through extensive datasets to identify potential digital risks and forecast catastrophic events before they unfold. These analytics support carriers in refining underwriting guidelines, accurately setting premiums, and crafting proactive risk mitigation strategies. This proactive stance on risk management significantly enhances portfolio durability and overall risk management efficacy.

MODERN DIGITAL

RISK MANAGEMENT

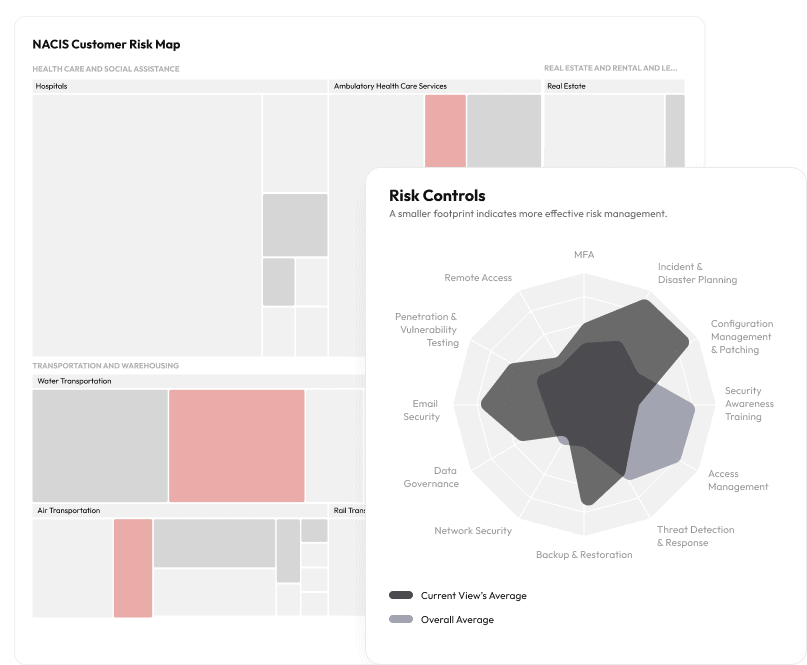

RISK DETECTION

Gain immediate, comprehensive insights with Exposurescape’s AI-driven detection capabilities, enabling underwriters to swiftly identify and assess emerging risks with unparalleled depth and accuracy.

RAPID RESPONSE

Leverage unmatched agility to formulate and execute responsive strategies effectively. Exposurescape’s real-time analytics power quick decisions, allowing for immediate action to preemptively address and neutralize risks.

MITIGATION

Deploy highly focused, data-informed mitigation strategies that precisely target key vulnerabilities, significantly minimizing portfolio exposure. This targeted approach ensures efficient use of resources, optimizing risk management cycle times for enhanced portfolio protection.

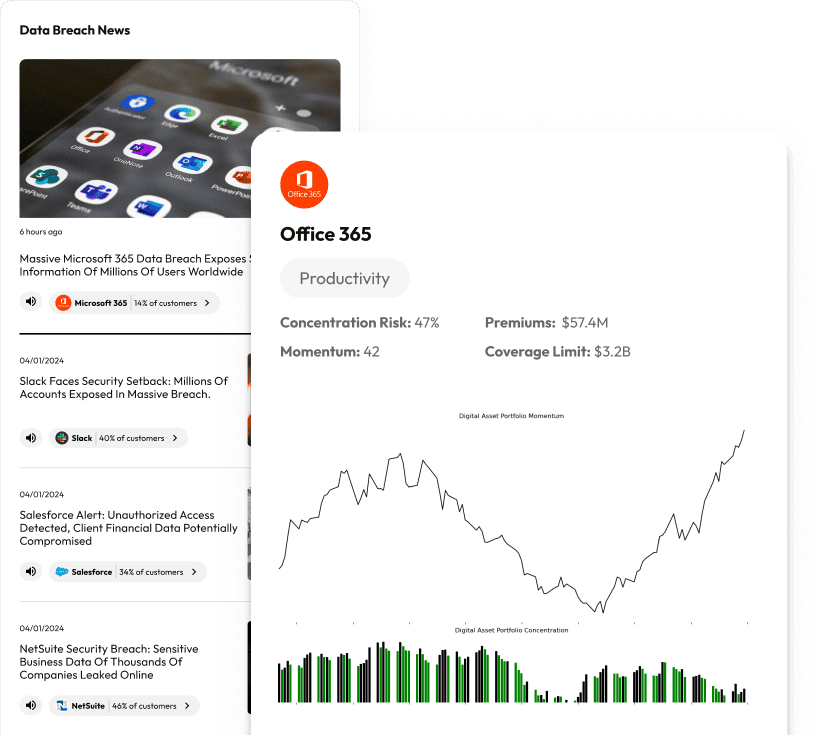

Digital Risk Exposure Detection

COMPREHENSIVE DETECTION

OF EMERGING DIGITAL

RISK PATTERNS

Exposurescape employs state-of-the-art AI and digital telematics to continuously monitor digital risk patterns, providing a robust platform that anticipates and pinpoints emerging risks.

Benefit: Gain instant, actionable insights with integrated alerts, allowing carriers and reinsurers to swiftly adapt their underwriting processes for preemptive risk mitigation.

PREDICTIVE ANALYTICS FOR CATASTROPHIC RISK

FORECASTING FOR CATASTROPHIC

DIGITAL EVENTS AND

EMERGING RISK PATTERNS

Through meticulous data analysis and AI, Exposurescape predicts potential catastrophic digital events, empowering insurers with the foresight needed for strategic defense.

Benefit: Equip your policies with foresight to adjust strategies ahead of time, safeguarding portfolios from the significant impacts of digital disasters.

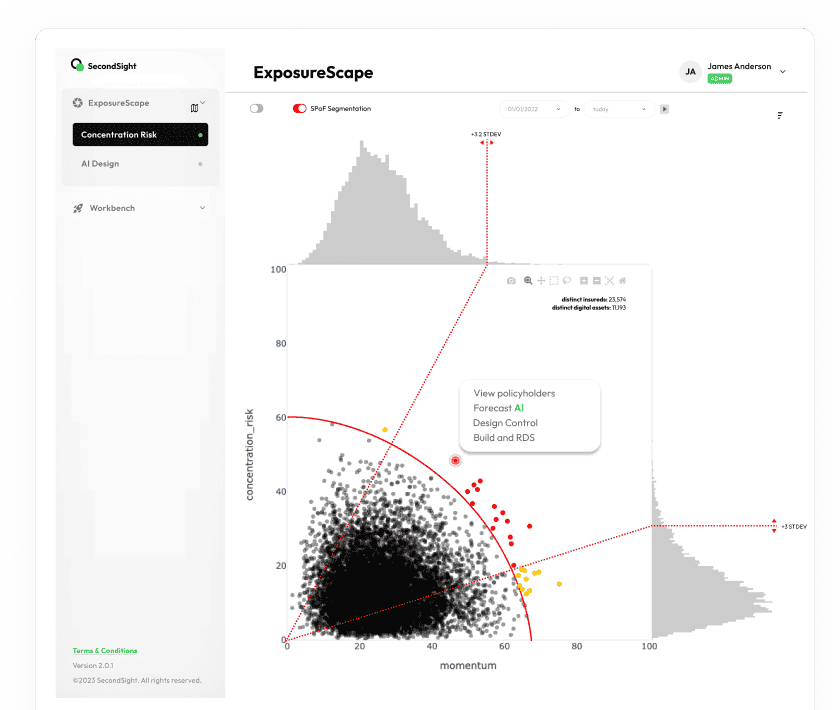

PORTFOLIO RISK DIVERSIFICATION

INTELLIGENT

DIVERSIFICATION OF

DIGITAL RISK PORTFOLIO

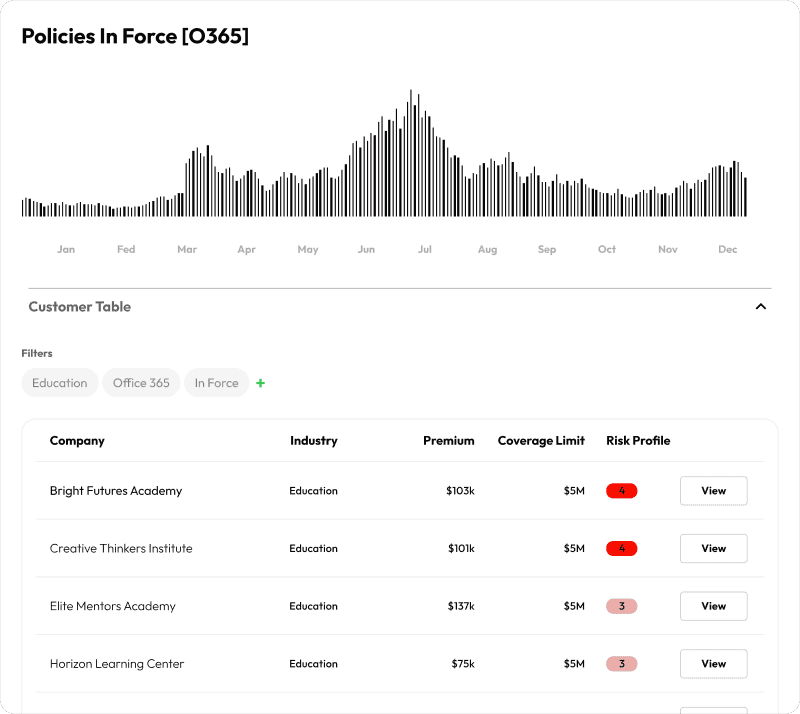

Exposurescape’s analytics spotlight risk concentrations within digital portfolios, providing guidance for strategic diversification and balanced risk distribution.

Benefit: Evade the pitfalls of risk concentration and foster a resilient, growth-oriented portfolio with informed analytics from Exposurescape.

DYNAMIC ADAPTATION TO DIGITAL RISK

AGILE ADAPTATION TO

NEW DIGITAL RISK

SCENARIOS

With Exposurescape’s AI-powered continuous learning models, stay in sync with the ever-evolving digital risk landscape for real-time risk assessment and strategy evolution.

Benefit: Stay ahead of emerging risks with a platform designed for agility, ensuring your risk management strategies evolve as quickly as the digital world itself.

PREDICTIVE PRICING FOR DYNAMIC UNDERWRITING

PREDICITIVE PRICING

ALIGNED WITH DIGITAL

RISK PATTERNS

Exposurescape’s predictive models use the latest digital risk data to enhance the accuracy of risk pricing and underwriting decisions.

Benefit: Leverage adaptive pricing for a precise risk assessment and innovative product development, keeping your business at the competitive edge.

YOUR DISTRIBUTION PARTNER

EMPOWERING A NETWORK

OF OVER 70 BROKERAGES

SecondSight stands as a proven distribution platform

that transcends technology, fostering trusted partnerships

and driving industry innovation forward.