BROKER

WORKBENCH

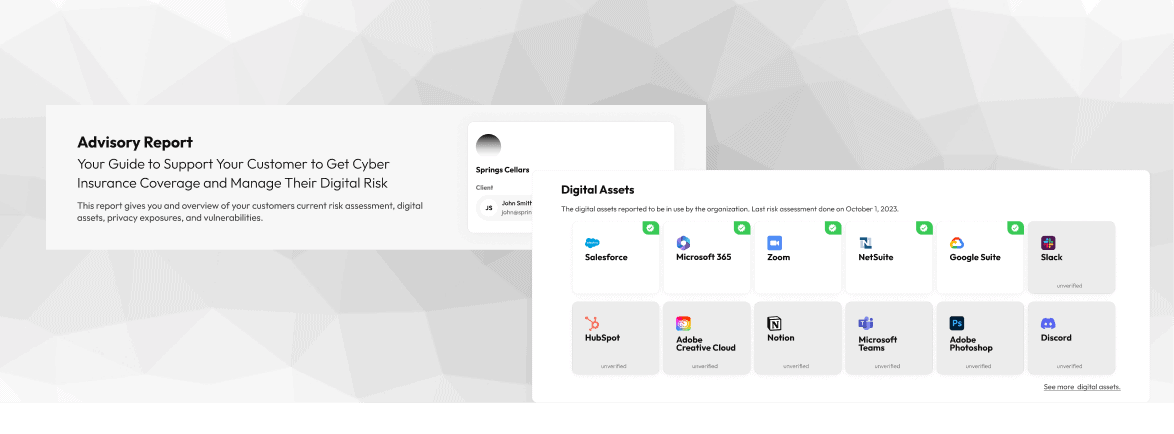

SecondSight’s Broker Workbench is an integrated platform designed to digitize the cyber insurance process for brokers. It combines cutting-edge technology with user-friendly features to streamline the entire insurance lifecycle, from client onboarding to policy renewal and risk management.

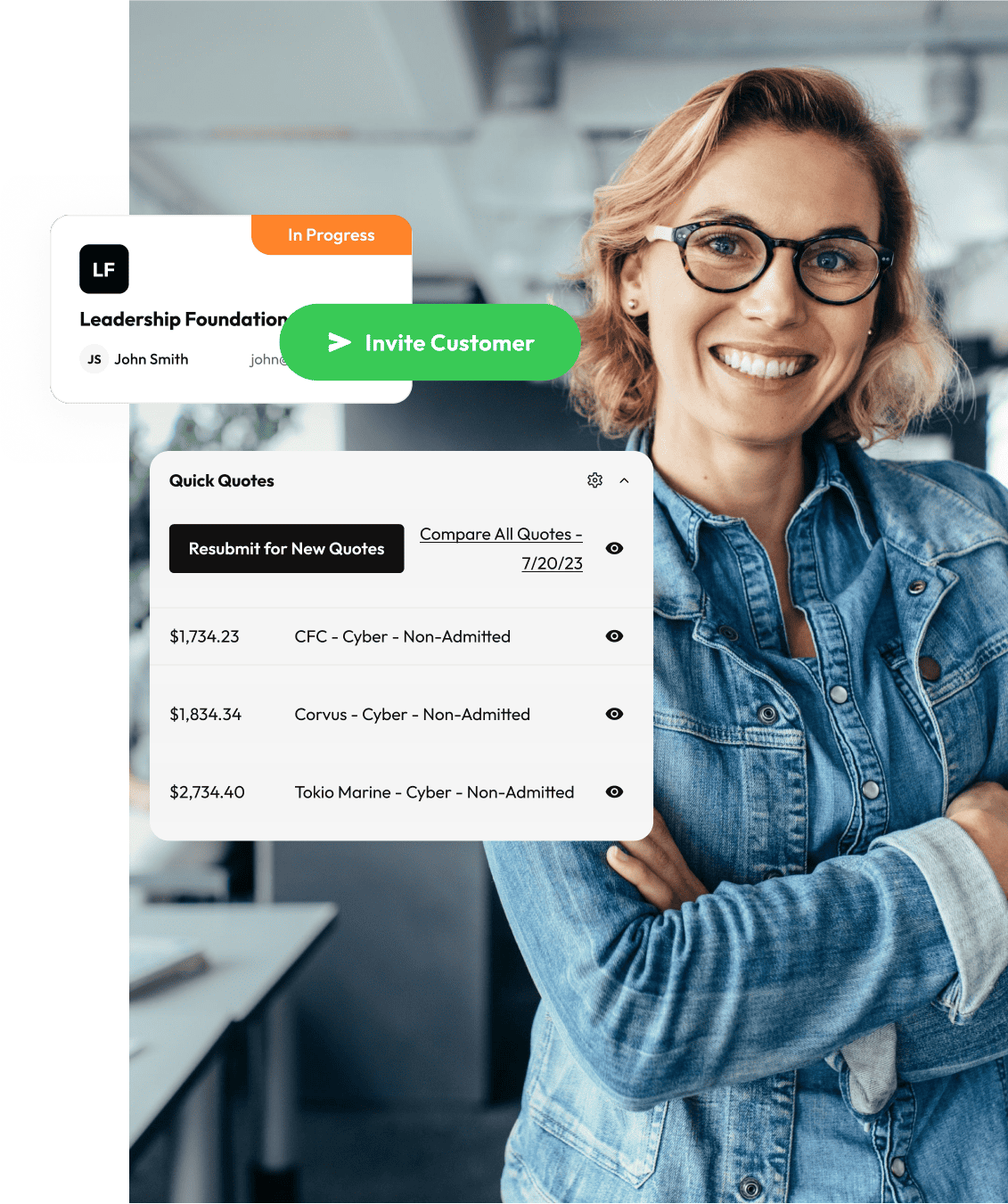

Brokers can quote, compare and bind digitally across 18 Top Tier Markets, form our auto complete allows brokers to quickly complete forms across all top tier markets.

Broker Workbench accommodates various needs with tiered pricing: Individual packages are free annually, Teams at $29 per broker per month, Teams+ at $49 per broker per month, and custom pricing available for Enterprise solutions.

THE MODERN

BROKER EXPERIENCE

BUSINESS PLANS

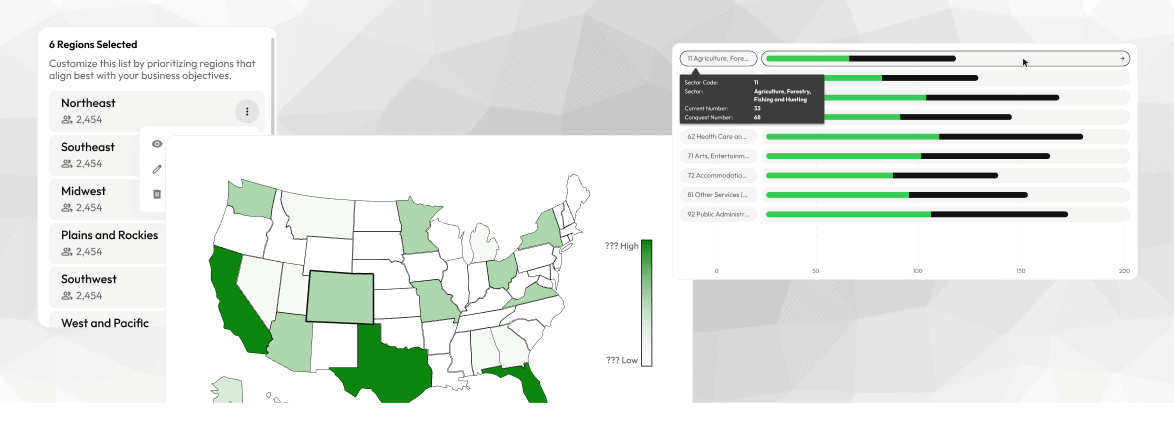

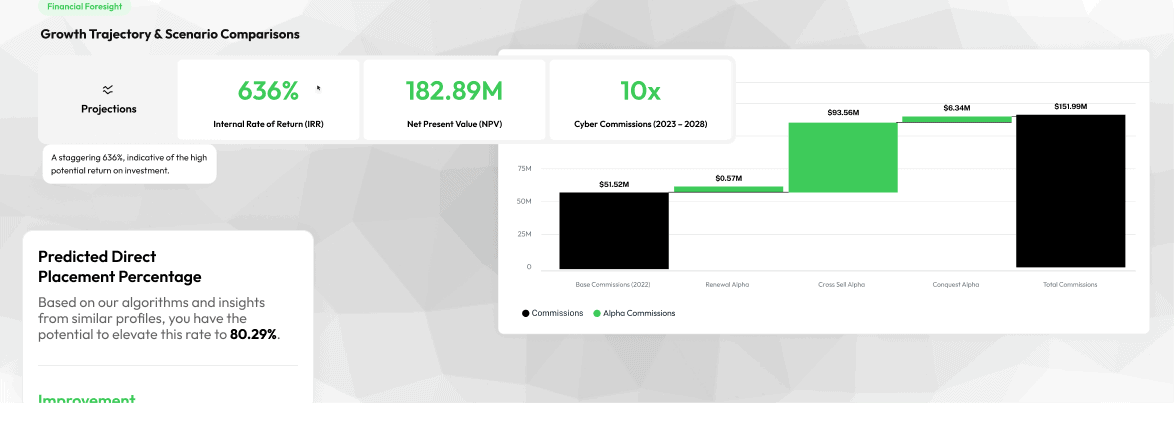

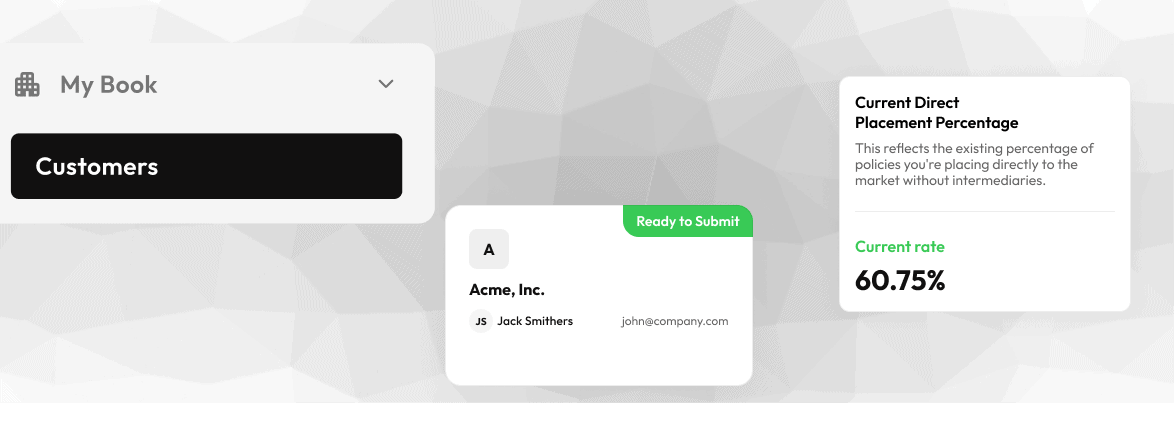

Utilize our advanced analytics to develop strategic business plans. Our AI-driven insights enable you to identify market opportunities and tailor your approaches to meet the evolving needs of your clients.

AUTOMATED QUOTING

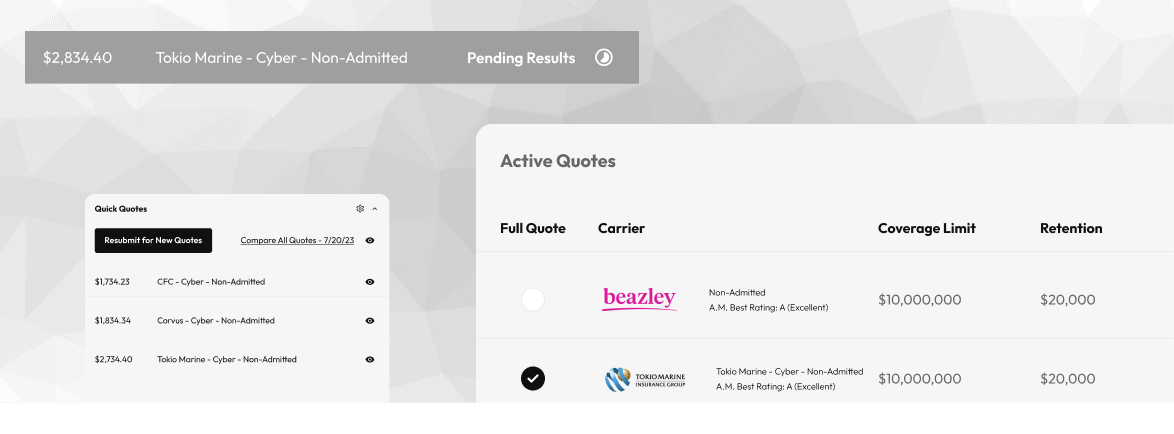

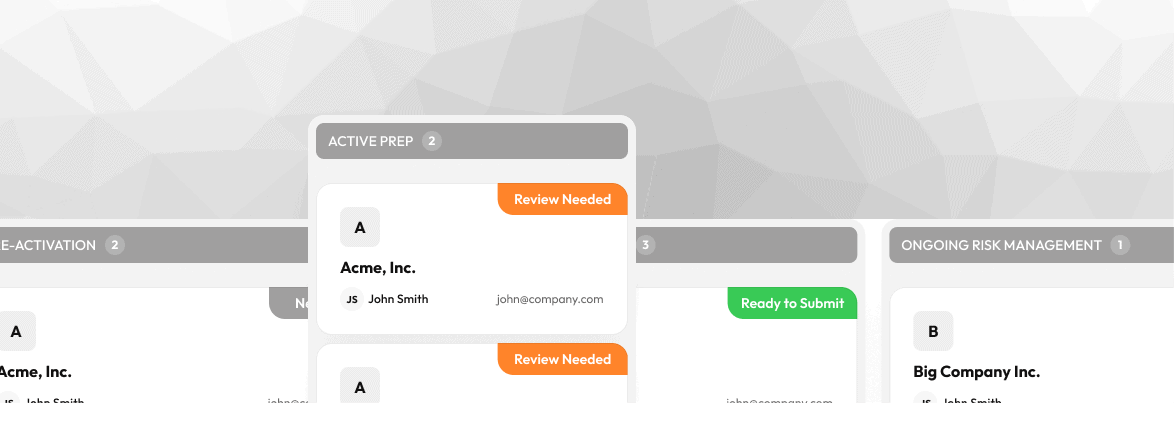

The placement process is simplified with our tools for product comparison and automated quoting. You can quickly find the best match for your client’s needs while maintaining regulatory compliance. This makes your job easier, more accurate and efficient.

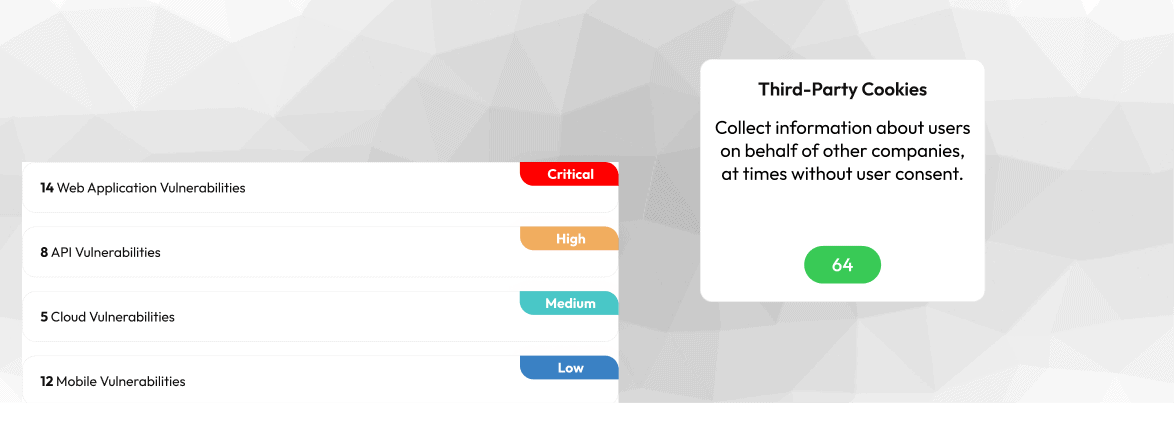

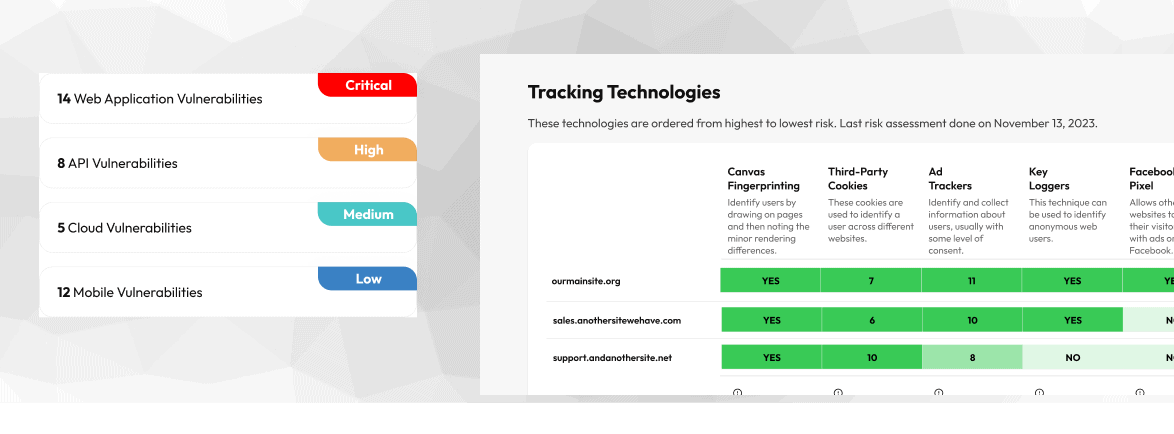

EVOLVING RISKS

With SecondSight, client protection is a continuous journey. Our AI-driven tools actively monitor and manage evolving risks, allowing you to adjust strategies and understand new exposures in real-time.

PLAN

CRAFT TARGETED BUSINESS PLANS

PLACE

SIMPLIFY PRODUCT COMPARISON & AUTOMATED QUOTING

RETAIN

ACTIVELY MANAGE EVOLVING RISKS

A PLAN THAT FITS

YOUR BUSINESS

Designed for individual brokers and offers a focused set of tools for managing client relationships and automating the quote and bind process

Aimed at small teams within brokerages, this package expands on the individual offering by adding team collaboration features and enhanced reporting capabilities.

The most comprehensive package tailored for large enterprises, offering a full suite of features for detailed risk management, customization, and integration with existing systems.