In the intricate world of cyber insurance, brokers face the dual challenge of staying abreast of the latest threats while ensuring they provide accurate, comprehensive coverage. A significant aspect of this is managing Errors & Omissions (E&O) risks, which can be as volatile as the cyber landscape itself.

SecondSight stands at the intersection of technology and brokerage, offering a suite of tools designed to enhance brokers’ understanding, management, and mitigation of cyber risks, thus reducing the potential for E&O liabilities. In our latest visual exploration, “5 Ways SecondSight Reduces E&O Risk for Cyber Insurance Brokers,” we break down how our platform contributes to a more secure, efficient, and error-proof insurance process.

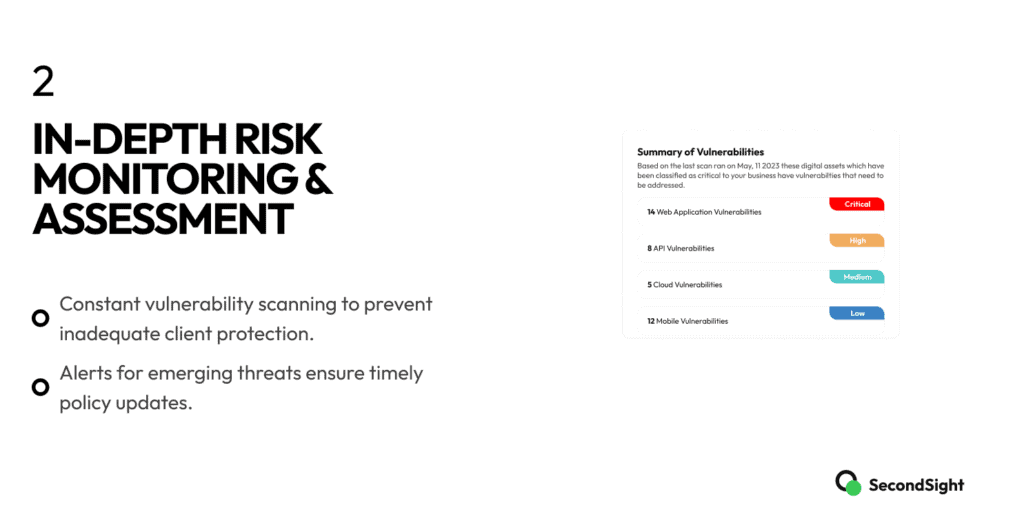

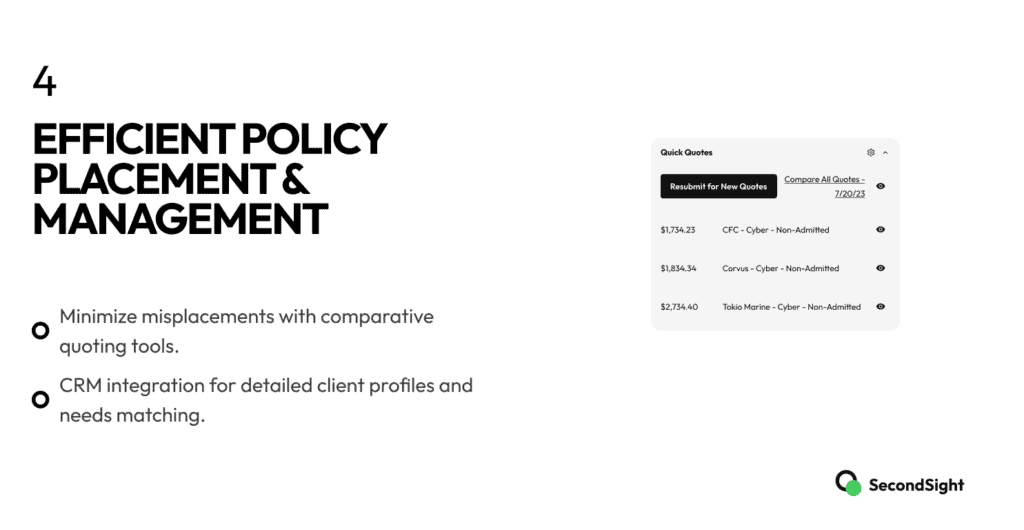

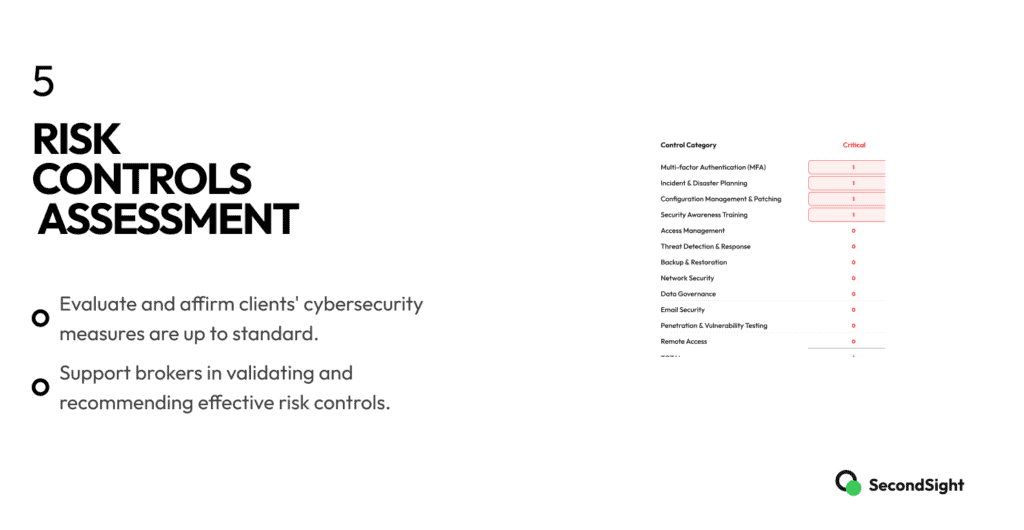

From automating application processes to leveraging continuous risk monitoring, and facilitating informed policy placements, SecondSight empowers brokers to confidently navigate the cyber insurance domain. Our integrated approach ensures legal and compliance standards are met, all while maintaining the delicate balance of legal privilege.

Explore the slideshow in this post for a distilled view of how SecondSight not only simplifies the complexity inherent in cyber insurance but also provides a shield against the reputational and financial consequences of E&O claims.