In the rapidly evolving realm of cyber insurance, brokers face the dual challenge of optimizing their portfolio performance while adapting to an ever-shifting threat landscape. Enter SecondSight, a sophisticated AI-driven platform engineered to empower brokers in amplifying their cyber revenue by seamlessly navigating the insurance lifecycle: Plan, Place, Retain.

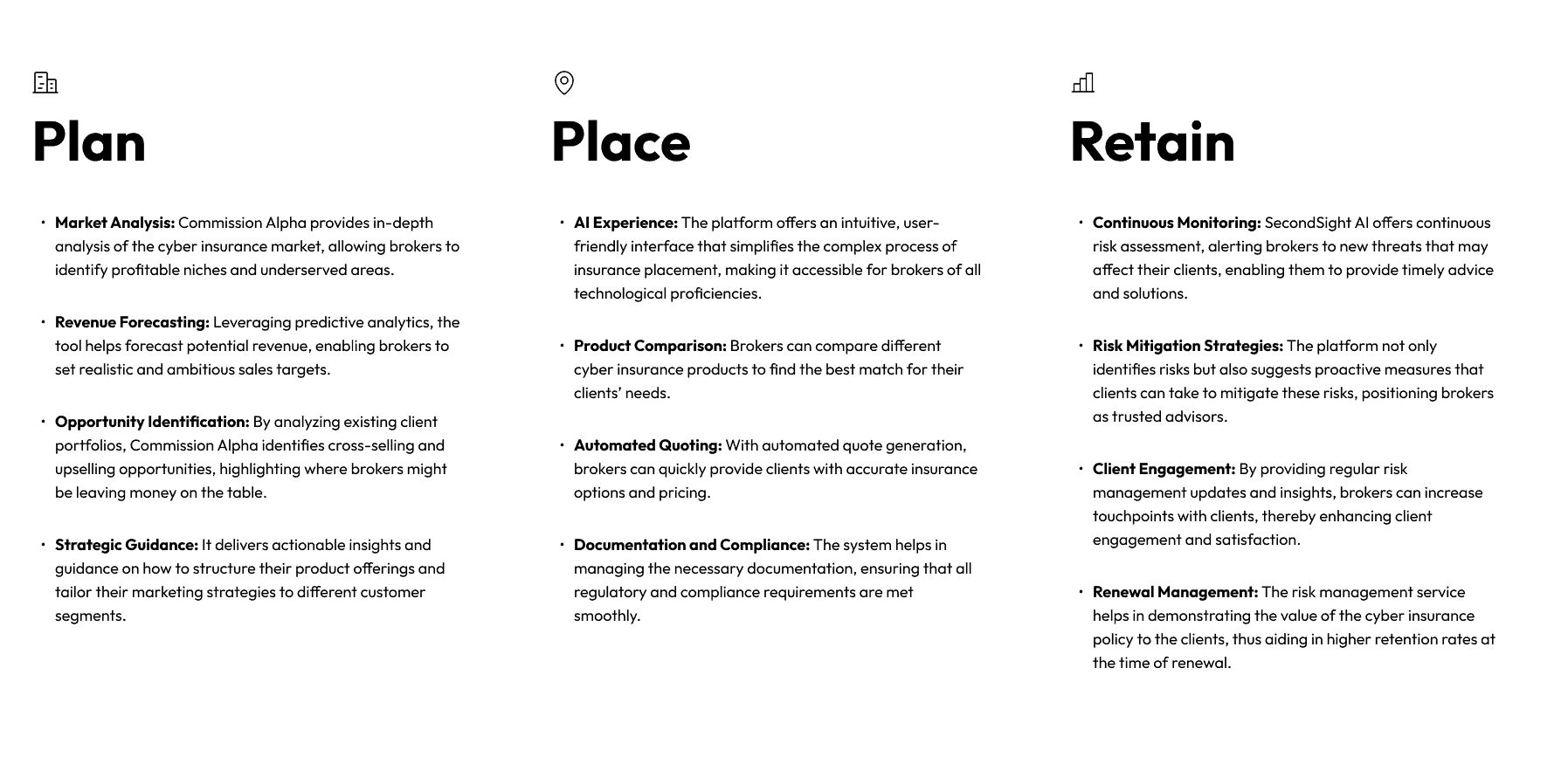

Plan: Crafting a Lucrative Roadmap with Precision Analytics

SecondSight’s Commission Alpha is a game-changer for brokers aiming to leave no stone unturned in the cyber insurance market. It arms them with advanced market analysis tools that uncover the most profitable niches and identify gaps in the market that are ripe for growth. With the power of predictive analytics, brokers can set ambitious yet achievable sales targets, effectively turning data into dollars.

Place: Streamlining Insurance Placement with AI Efficiency

The placement phase is where SecondSight truly shines, offering a digital platform that transcends traditional boundaries. Brokers, regardless of their tech savviness, are greeted by an AI Experience that demystifies the insurance placement process. This enables them to conduct swift product comparisons, offer automated quotes, and manage regulatory compliance with unprecedented ease and accuracy.

Retain: Cementing Client Loyalty with Proactive Engagement

Maintaining and growing client relationships is critical in the post-sale journey. SecondSight’s AI toolkit is designed to keep brokers ahead of the curve through continuous risk assessment and targeted risk mitigation strategies. This proactive engagement, coupled with sophisticated renewal management, not only preserves but also deepens the broker-client bond, leading to sustained satisfaction and retention.

Empowering Brokers with a Suite of Advanced Capabilities

- Market Analysis: Commission Alpha provides in-depth insights into the cyber insurance arena, ensuring brokers have a finger on the pulse of market trends and opportunities.

- AI Experience: The user-friendly interface simplifies complex processes, making the art of insurance placement accessible and streamlined.

- Continuous Monitoring: SecondSight’s AI vigilantly monitors the cyber landscape, alerting brokers to emerging threats that could impact their clients.

- Revenue Forecasting: The platform’s predictive analytics capability allows brokers to forecast future earnings with a higher degree of confidence.

- Product Comparison: It facilitates quick and effective comparison across various cyber insurance products, ensuring the best fit for clients.

- Risk Mitigation Strategies: The platform serves as a beacon, guiding clients through the fog of cyber risk with actionable mitigation strategies.

- Opportunity Identification: By analyzing client portfolios, it uncovers hidden cross-selling and upselling avenues, thereby maximizing revenue potential.

- Automated Quoting: Efficiency is at the heart of the platform, with automated quoting that accelerates the policy issuance process.

- Client Engagement: Regular risk management updates and insights enhance broker-client interactions, fostering deeper relationships.

- Strategic Guidance: It provides brokers with the strategic acumen to tailor their offerings and marketing strategies effectively.

- Documentation and Compliance: SecondSight ensures that the tedium of documentation and compliance is handled with precision and ease.

- Renewal Management: The platform showcases the lasting value of cyber insurance policies, encouraging higher retention rates at renewal time.