The digital landscape is evolving rapidly, presenting a complex array of risks that challenge traditional risk management practices. In response, the introduction of Exposurescape, as a pivotal feature within the Underwriter Workbench, marks a significant leap forward. This innovative tool is changing the way carriers and reinsurers see, assess, and manage digital risk, offering a comprehensive, data-driven approach that aligns with the needs of the modern digital world.

The Challenge of Digital Risks

Digital risks encompass a broad spectrum, from cyber threats and data breaches to technological vulnerabilities that can disrupt operations and cause significant financial loss. Traditional methods of risk assessment often fall short in accurately predicting these dynamic and evolving threats, leaving insurers searching for more reliable and adaptive solutions.

Exposurescape: A Comprehensive Solution

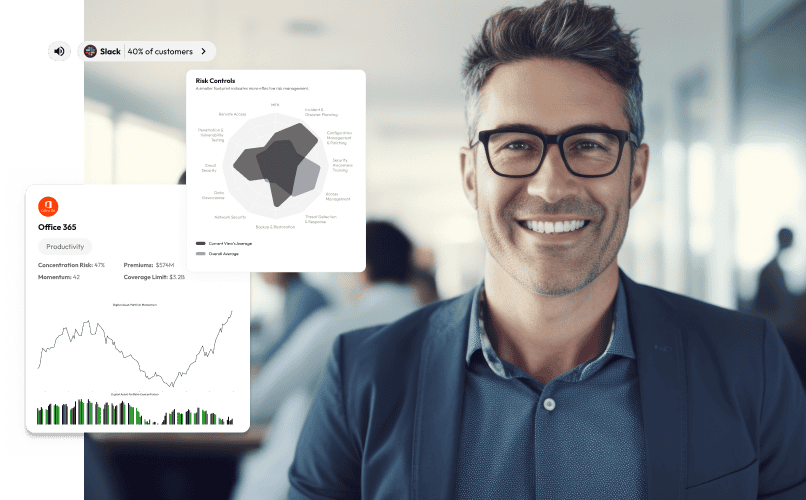

Exposurescape stands out by offering a multi-faceted approach to digital risk management, incorporating predictive analytics, real-time risk monitoring, and strategic portfolio management into a single, integrated platform. Here’s how it’s changing the game for carriers and reinsurers:

- Predictive Analytics for Underwriting: Utilizing AI-driven analytics, Exposurescape enables underwriters to deeply understand and accurately profile digital risks. This advanced analysis facilitates more precise underwriting, enhancing the accuracy and reliability of risk assessments.

- Real-Time Risk Monitoring: Beyond static assessments, Exposurescape continuously monitors the digital landscape for emerging threats. This capability ensures that carriers can proactively manage risks, adapting their strategies to address threats as they arise.

- Strategic Portfolio Management: Exposurescape provides invaluable insights into risk concentrations and advises on diversification strategies, helping carriers optimize their portfolios for resilience against sector-specific downturns and systemic risks.

Transformative Impact on Carriers

By integrating Exposurescape into their risk management strategies, carriers and reinsurers are empowered to move from reactive to proactive stances. The tool’s predictive capabilities allow for the anticipation of risks before they manifest, offering a strategic advantage in a market that values foresight and preparation.

The real-time risk monitoring feature of Exposurescape assures that carriers are always informed of the latest threats, enabling swift and informed decision-making. Furthermore, the strategic portfolio management capabilities ensure that risk exposures are balanced and diversified, reducing vulnerabilities and enhancing portfolio health.

Looking Ahead

The integration of Exposurescape within the Underwriter Workbench represents the future of risk management in the digital age. For carriers and reinsurers, this means a shift towards more agile, informed, and precise risk assessment and management practices. As digital risks continue to evolve, having a tool that adapts and responds to these changes is invaluable.

Exposurescape is not just a tool but a comprehensive solution that redefines the landscape of digital risk management for carriers and reinsurers. By offering precise underwriting, real-time threat monitoring, and strategic portfolio management, it ensures that carriers can confidently navigate the complexities of the digital age. In embracing Exposurescape, the insurance industry can look forward to a future where digital risks are managed with unprecedented clarity and effectiveness.