In the digital age, businesses of all sizes are increasingly vulnerable to cyber threats, which can disrupt operations, erode customer trust, and result in significant financial losses. Traditional approaches to cyber insurance have often been complex, opaque, and reactive, leaving many companies underinsured or uninsured against these risks. Recognizing this gap, SecondSight has embarked on a mission to transform the cyber insurance landscape with a vision of making it accessible, transparent, and proactive, thereby enhancing global economic resilience and fostering a safer digital environment.

A Vision of Accessibility and Resilience

At SecondSight, we believe that every business, regardless of size, should have the means to protect itself against cyber threats. Our vision is to democratize cyber insurance, making it a straightforward and essential part of every company’s risk management strategy. By doing so, we aim to contribute to the overall resilience of the global economy, as businesses become better equipped to handle the challenges of the digital world.

Mission: Streamlining Cyber Insurance

Our mission is to eliminate the friction traditionally associated with cyber insurance. We strive to provide unparalleled pricing transparency and radically simplify the insurance process for businesses. By leveraging innovative technology and customer-centric services, we are dedicated to increasing the adoption of cyber insurance, ensuring that businesses have the necessary tools to grow and thrive in the digital economy.

Empowering Brokers with a Revolutionary Platform

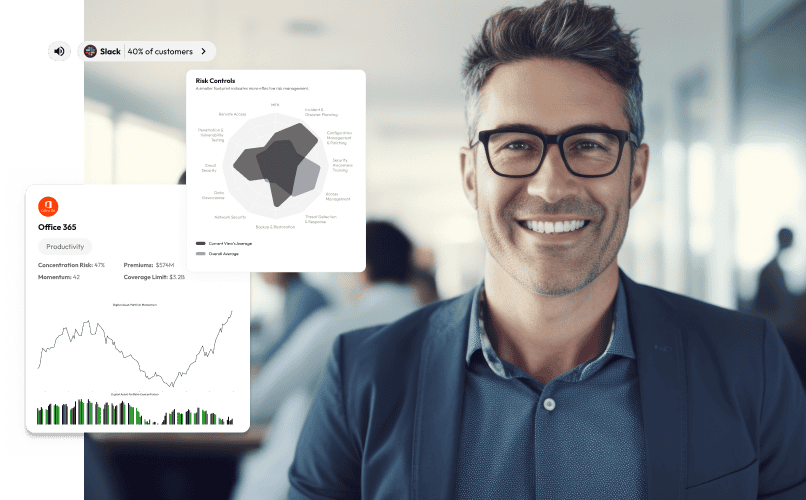

SecondSight’s positioning is clear: we empower brokers with a cutting-edge cyber insurance and risk management platform that redefines how cyber risks are assessed, policies are chosen, and ongoing risk management is handled. Our platform serves as a critical bridge between brokers and their clients, offering an intuitive aggregator for sourcing and comparing cyber insurance policies tailored to unique risk profiles.

Once policies are bound, our platform transitions into a dynamic, always-on tool for continuous risk monitoring and remediation facilitation. With SecondSight, brokers gain a competitive edge by providing comprehensive, streamlined, and proactive cyber insurance solutions.

Platform Capabilities: A Deep Dive

- Risk Profiling and Analysis: Our platform enables brokers to accurately assess and understand their clients’ cyber risk profiles, laying the foundation for informed decision-making and tailored insurance solutions.

- Insurance Market Aggregator: As an aggregator, SecondSight streamlines the insurance selection process, allowing brokers to offer a diverse range of policy options and find the optimal coverage for each unique risk profile.

- Policy Binding Interface: Our interface simplifies the finalization of the insurance process, acting as a seamless conduit between insurance providers and companies.

- Continuous Risk Monitoring Tool: Post-policy binding, our tool represents a shift to proactive risk management, ensuring that evolving risks are continuously monitored.

- Remediation Marketplace: Beyond insurance, our platform offers solutions for risk mitigation through partnerships with Managed Service Providers (MSPs), enabling brokers to provide comprehensive risk management strategies.

- Collaborative Platform for Brokers and Clients: SecondSight fosters collaboration throughout the insurance lifecycle, enhancing the broker-client relationship and ensuring a cohesive and responsive service experience.

Transforming the CFO’s Role in Cyber Risk Management

For Chief Financial Officers (CFOs), the implications of SecondSight’s platform are profound. CFOs play a crucial role in managing a company’s financial risks, and cyber threats are increasingly a significant part of that equation. Our platform provides CFOs with the tools to understand and mitigate these risks effectively.

Through features like continuous risk monitoring and the remediation marketplace, CFOs can ensure their company’s cyber insurance coverage is responsive to the dynamic digital risk landscape. The platform’s client-centric approach in the renewal process means that policies are not just renewed but are consciously invested in, evolving with the company’s needs. This strategic approach fosters trust and loyalty, enhancing client satisfaction and retention.

A New Standard in Cyber Insurance

SecondSight is setting a new standard in the cyber insurance industry. By combining advanced technology with expert knowledge and personalized client care, we are fostering robust and enduring relationships in the cyber insurance domain. Our platform positions brokers as both knowledgeable advisors and responsive supporters, crucial for navigating the complexities of cyber risks and insurance solutions.

In an era where digital threats are ever-present and evolving, SecondSight’s vision, mission, and platform capabilities represent a beacon of innovation and security. We are not just changing the way companies manage digital risk; we are redefining the very nature of cyber insurance for a safer and more resilient digital future.